Wonderful Tips About How To Sell Short Treasury Bonds

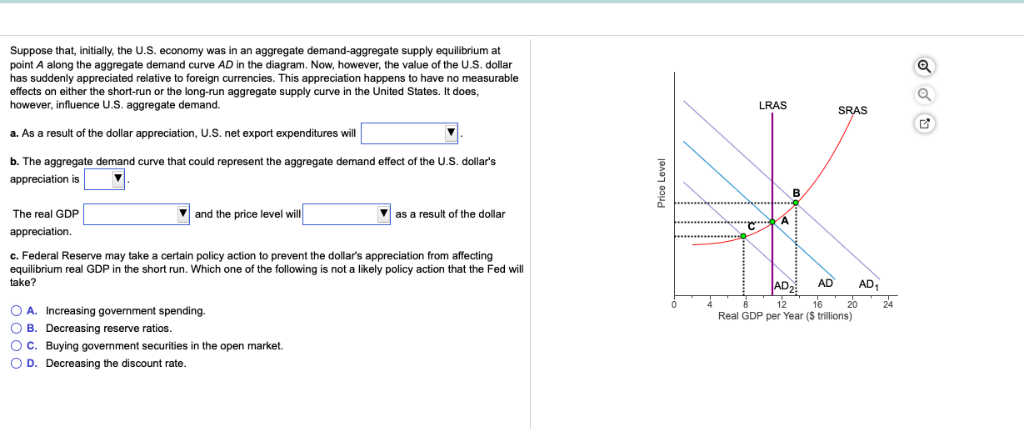

In a short sale of treasury bonds, an investor borrows the bonds and then sells them to lock in the current price, betting prices will fall before the investor has to buy them back.

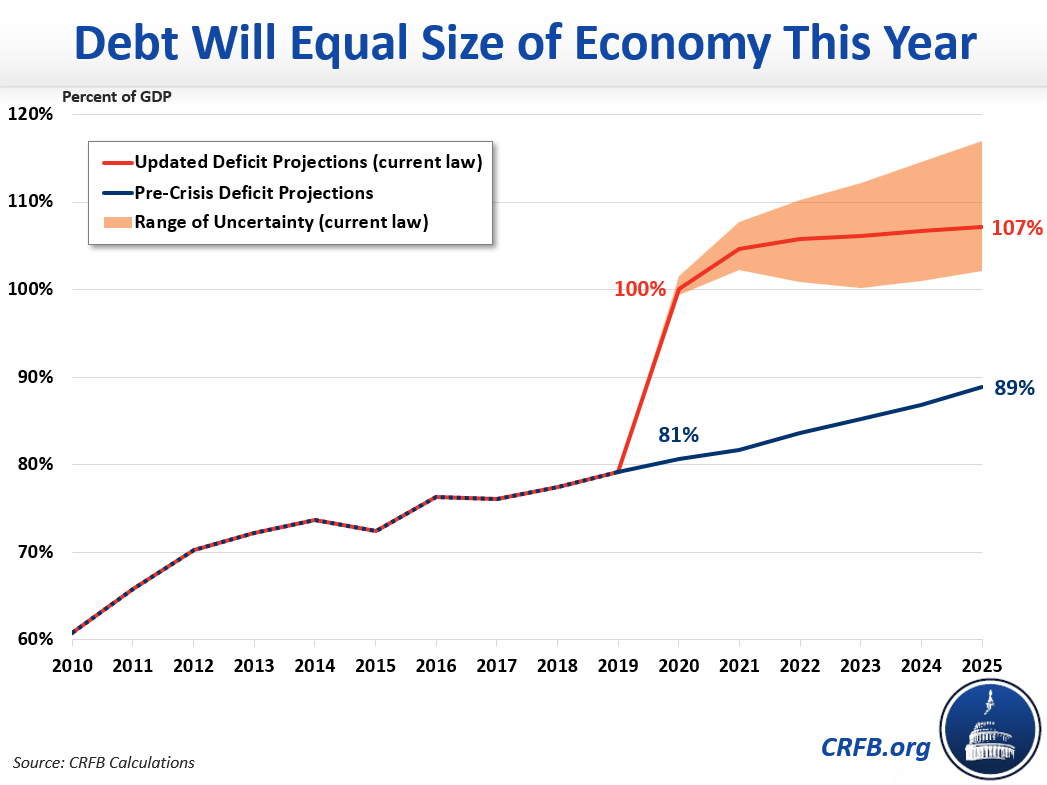

How to sell short treasury bonds. Nasdaq shv opened at $110.04 on friday. In either case, at maturity a bond will be worth exactly its face value.keep this in mind as it will be a key fact in the next section. They are issued in a term of 30 years.

Treasury bonds pay a fixed rate of interest every six months until they mature. Selling treasury bonds for a treasury bond held in treasurydirect: However, depending on the institution, you.

Use fs form 1522 to cash out via treasurydirect. 6 hours agoishares short treasury bond etf trading up 0.0 %. It's probably the easiest method since the broker will watch the us treasury department auctions and place your bid for you.

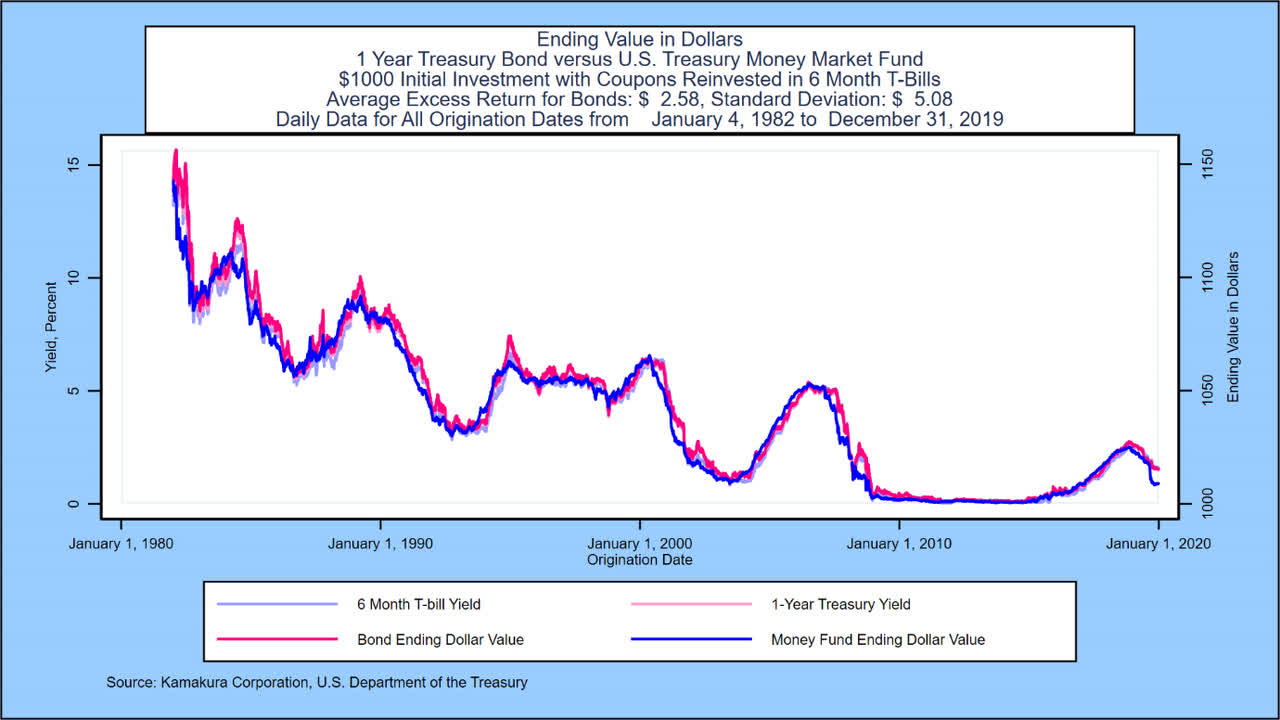

Here is a video overview of how it all works. It is possible to sell short bonds by borrowing them and selling them in the market, hoping to buy them back lower. “the bank of england, in line with its financial stability objective, carefully monitors financial markets and any potential risk to the flow of.

4 hours agoyou can invest with cash, cpf or srs funds without an overall limit, and — unlike with sgs bonds, which pay investors in coupons — receive the full value upon maturity. Find out what services a dedicated financial advisor offers. Just log in to your account, select “managedirect” and use the link for cashing securities.

Start investing with us today. Learn about our financial advisor services. Ad read fisher investments' views on bonds before you run out of retirement savings.

/thinkstockphotos-76800047-5bfc349c46e0fb005146870a.jpg)

:max_bytes(150000):strip_icc()/WherecanIbuygovernmentbonds1_2-8e2ac360d217459eb54ebea0070eb5b5.png)