Best Of The Best Info About How To Avoid Capital Gains Taxes

“when selling a residence, a single homeowner gets a $250,000 capital gains tax exemption and a.

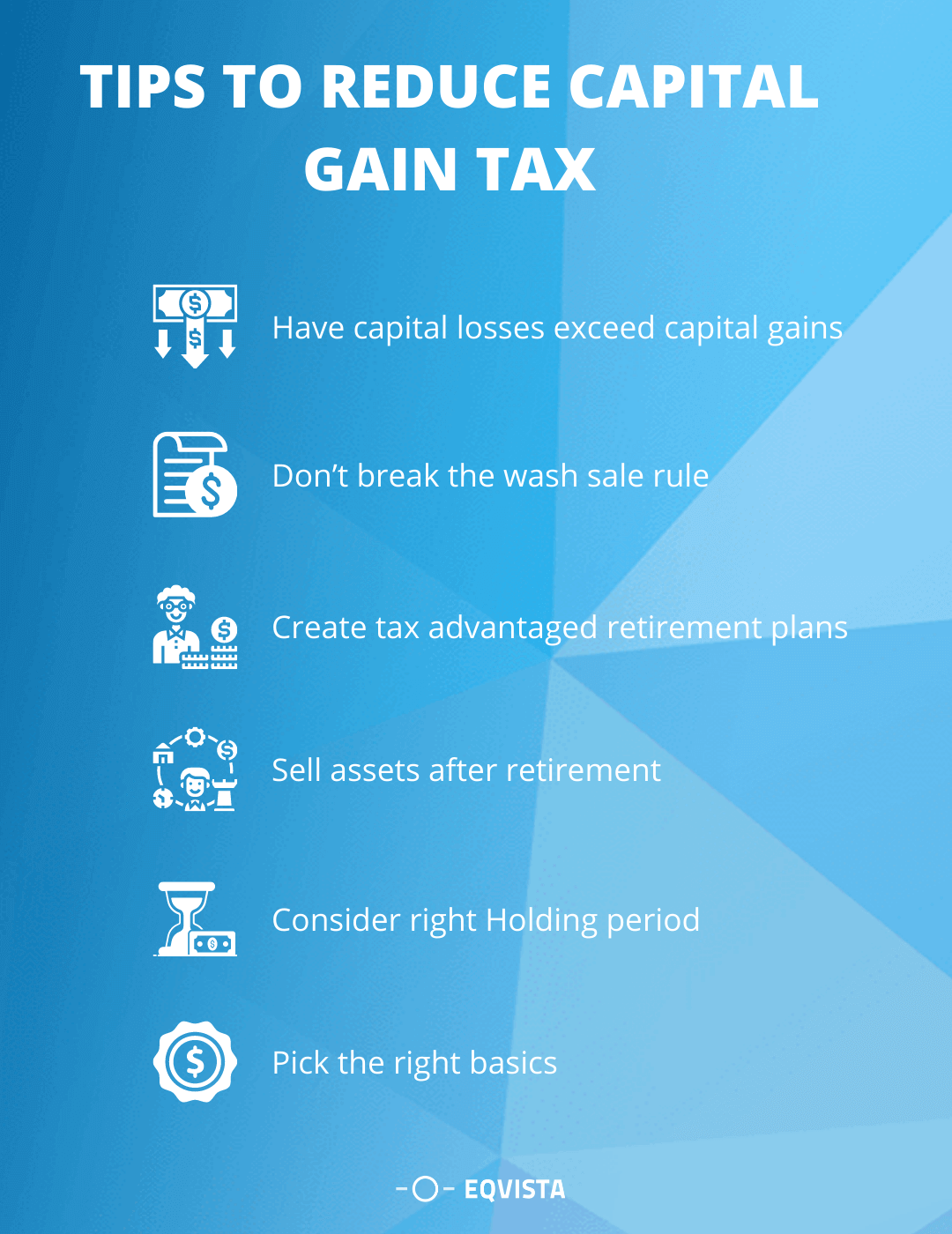

How to avoid capital gains taxes. To get around the capital gains tax, you need to live in your primary residence at least two of the five years before you sell it. 4 rows you can avoid paying taxes on the capital gains from appreciated land if you donate the land. Invest for the long term.

This is risky because the longer you invest,. One way to avoid capital gains tax is to simply hold your investments forever. Put your earnings in a tax shelter.

The main way to reduce your capital gains taxes is by making sure you calculate in all of the reductions that the irs allows to your overall profits. Live in the house for at least two years. Tax shelters act like an umbrella that shields your investments.

After that, the capital gains. Let’s say you sell shares of company. 9 ways to avoid capital gains taxes on stocks.

Then you have a capital loss deduction instead of a capital gain. The increase in capital gains taxes applies to individuals with income of $1 million or more, and takes the marginal tax rate from 20% to 39.6%. If you sell a house that.

If you hold a number of different assets, you may be able to offset some of your gains with any applicable losses, allowing you to avoid a portion of your capital gains taxes. Hold properties for at least a year. Capital losses can offset capital gains if you sell something for less than its basis, you have a capital loss.

![Video] Section 1031 Exchange Basics: How To Avoid Capital Gains Tax](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/Section-1031-Exchange-Basics-Video-1024x536.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)